Payments

Overview

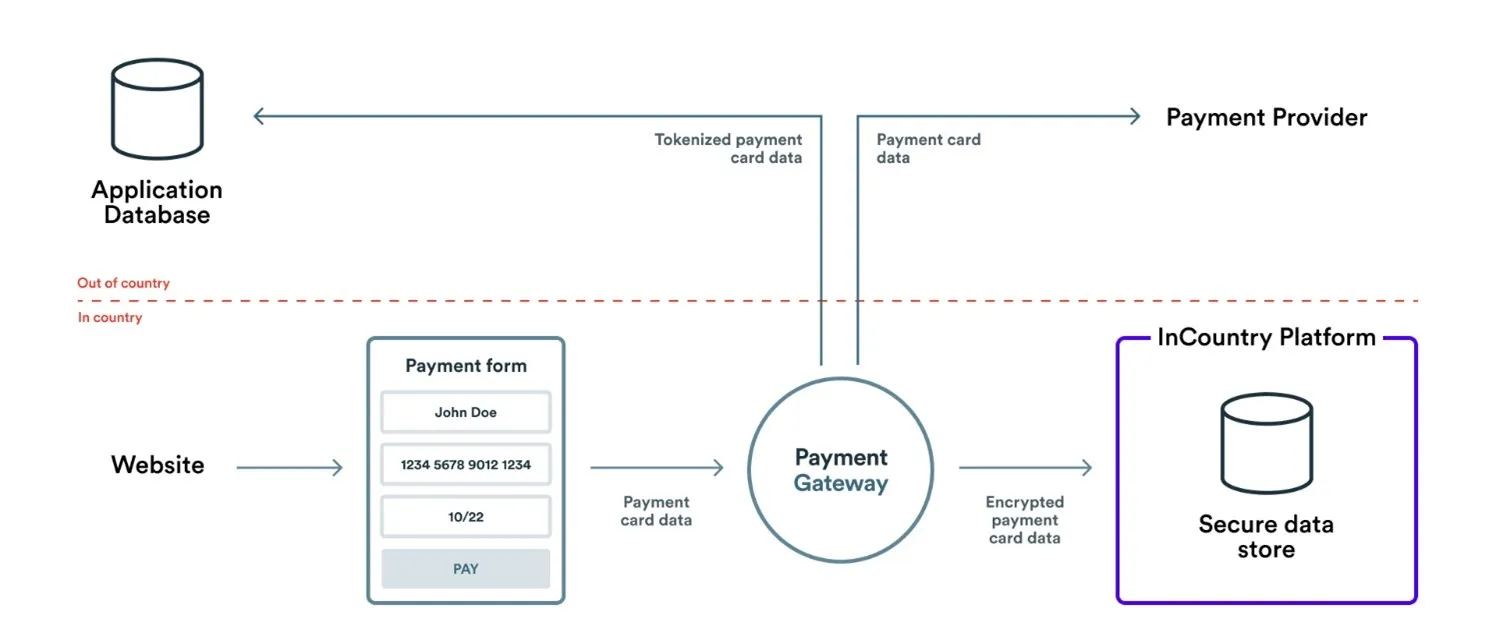

The InCountry Payments service is a part of the InCountry Data Residency-as-a-Service. This solution lets you secure payment card data within your application when performing outbound requests or handling incoming payment requests. It enables you to securely collect payment card data and store it on the InCountry platform with the InCountry JavaScript library (Payment Elements). It automates the provision of credit card data in the aliased (redacted) form to third-party payment providers, depending on your business requirements.

You can manage Payments services, as follows:

- create new Payments services

- delete the no longer needed Payments services

Solution

Payments solution consists of the following items:

-

Secure collection of payment card data in your application interface. InCountry Payment Elements (JavaScript library) allows you to securely collect payment card data of your customers without processing this data by your systems. Fields on the Payment Elements form operate like traditional input fields, while they secure access to the sensitive financial data.

-

Secure saving of payment card data to the InCountry platform and redaction of clear-text data into aliased equivalents. Aliased payment card data is useless for malefactors and hackers even if it is compromised, lost, or stolen. InCountry Payments securely processes and saves payment card data to the InCountry platform and generates aliases for it.

-

Secure provision of card data to payment providers on demand. InCountry Payments unredacts the aliased payment card data and provides it to a specific payment provider.

Secure Collection of Payment Card Data

You need to integrate the InCountry Payment Elements library into your application frontend. This component adds an IFrame element that renders a payment form loaded from the InCountry domain, so your application has no access to payment card data, which is required by PCI DSS.

Secure Saving of Payment Card Data

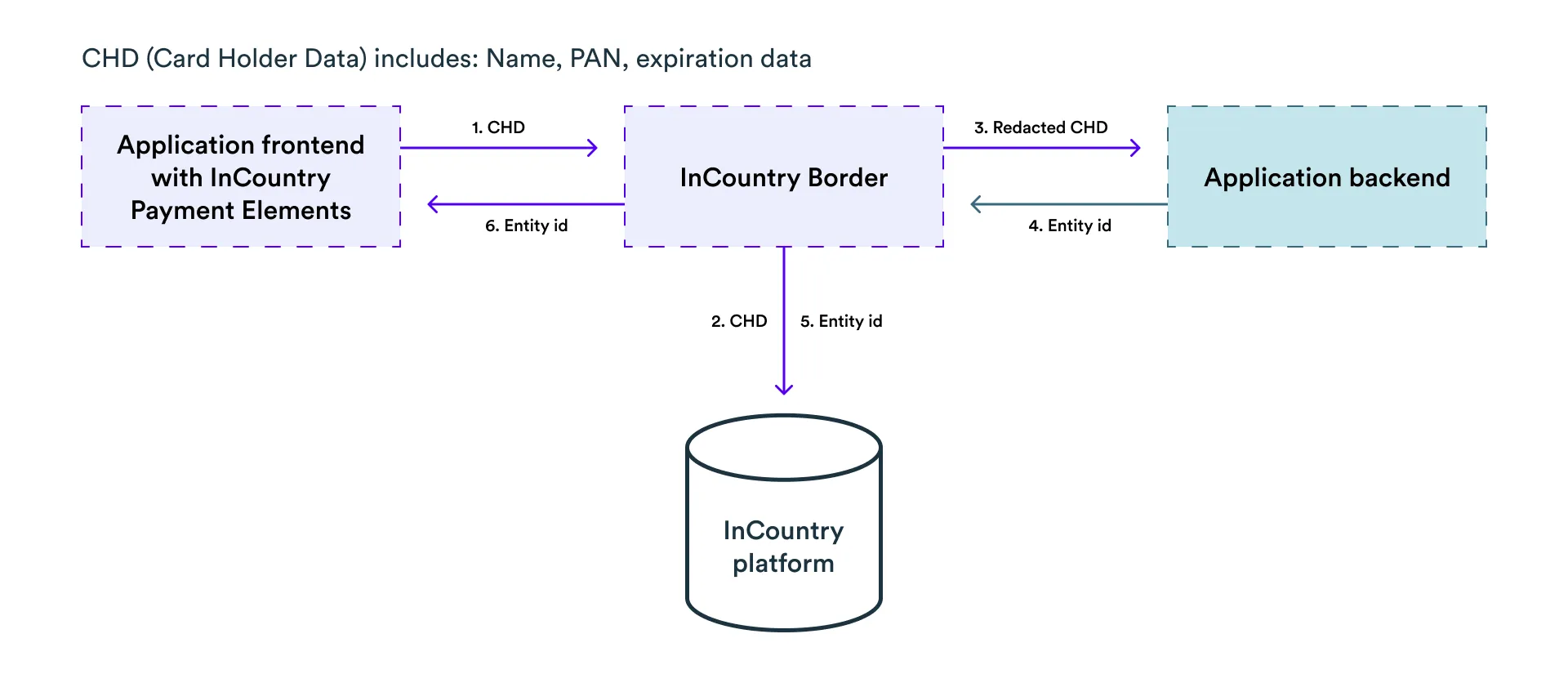

-

The payment form is rendered in the browser with the JavaScript library (Payment Elements) that passes the payment card data to InCountry.

-

InCountry Payments securely saves the payment card data to the InCountry platform.

-

InCountry Payments redacts this data with provider-agnostic alphanumeric tokens. This data by itself cannot be used even if it is lost, compromised, or stolen. Then InCountry Payments passes redacted data to your application backend to a specifically defined endpoint in your application. Neither InCountry Payments nor your application backend stores a CVC code in any form (plain, encrypted, or redacted).

-

Your application backend generates an identification token (entity id) and saves it to your application database for this card data record and returns an entity id in the response within the

x-inc-entity-idfield. For example, your response from your application could be:{

"x-inc-entity-id": "ZFEwRCJN1"

} -

InCountry Payments updates the record on the InCountry platform with the generated entity id.

-

InCountry Payments returns the created entity id to the browser.

Secure Provision of Card Data to Payment Providers

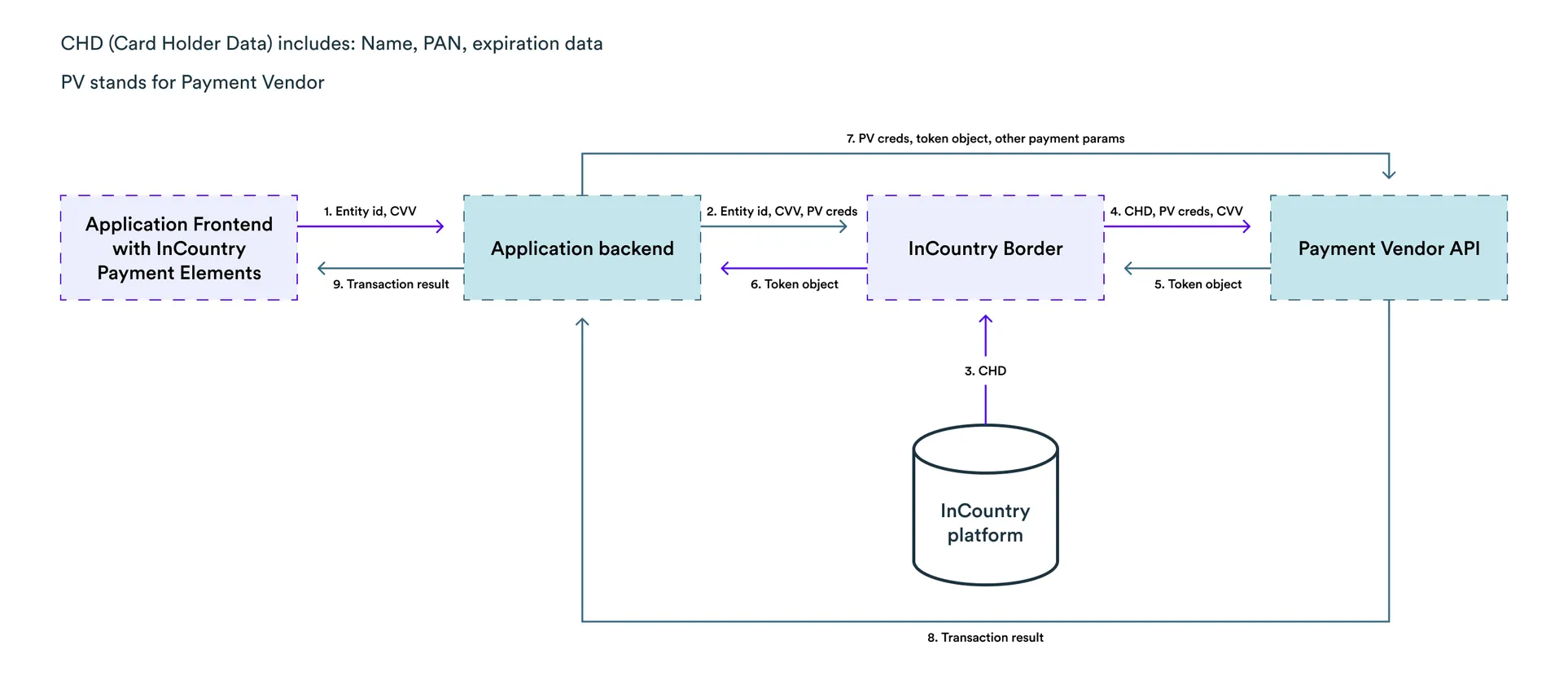

-

Your application in the browser sends an entity id and CVV/CVC to its backend.

-

Your application backend sends a request containing an entity id, CVV/CVC, and authorization credentials through InCountry to the payment provider to get a token object that represents the payment card data.

-

InCountry Payments fetches the payment card data by its entity id from the InCountry platform.

-

InCountry Payments fills out the payload with original payment card data in the pre-defined request format that is required by a payment provider and passes this request to the payment provider.

-

The payment provider returns a token object that represents provided payment data on the payment provider side. With this token, you can make payment transactions via payment provider.

-

InCountry Payments passes this token object to your application backend.

-

Having the payment provider credentials, token object, and other payment parameters, your application backend creates a payment transaction for the payment provider.

-

The payment provider returns the result for a created transaction.

-

Your application backend returns the transaction result to the application frontend.

Processing CVV/CVC Codes

The InCountry platform does not store CVV/CVC codes. InCountry Payments passes a CVV/CVC code as plain text over a secure HTTPS connection. This code may go through your application backend through the GET request, but must not be stored on your side to stay PCI DSS compliant, as the CVV/CVC code must be just passed and must not be stored.

How to Integrate InCountry Payments

- Create the Payments service on the InCountry Portal.

- Integrate the Payment Elements library into your payment workflow.

- Configure your payment logic with the desired payment provider (Stripe or Braintree) on your application.

All integrations with the InCountry DRaaS platform require a TLS handshake with the SNI (Server Name Indication) extension enabled. Please make sure that your TLS client is configured accordingly!

The Payment Elements library includes the two parts:

-

JavaScript code that is integrated into your application page to interact with the Payment Elements library.

-

JavaScript code that is loaded within an IFrame element (XSS protection) to manage the form elements data, styles, validation, and so on.

Integrating the Payment Elements library with Application Frontend

The generic workflow includes the following steps:

-

Include the Payment Elements script on each page of a website. It should always be loaded directly from the InCountry endpoint, rather than included within an application bundle or hosted on your premises.

-

Add a placeholder for the payment form.

-

Initialize the library.

-

Create a payment form.

-

Submit the payment card data.

-

Get the card’s entity id and CVV.

<!--

1. Include the Payment Elements script

-->

<script src="<INCOUNTRY_EMBEDED_CODE>"></script>

<!--

2. Add a placeholder for the payment form

-->

<span id="placeholder">

<!--iframe will rendered here-->

</span>

<script>

/// 3. Initialize the library

InCountry.initialize({ url: '<INCOUNTRY_IFRAME_SOURCE>' });

/// 4. Create a payment form

var cardForm = InCountry.form('#placeholder');

/// 5. Submit the payment card data

cardForm.submit(function(entityId, CVV) {

/// 6. Get the card entity id and CVV

fetch('https://your.server.io/buy', {

method: 'POST',

headers: { 'Content-Type': 'application/json' },

body: JSON.stringify({ card: entityId, CVV }),

})

.then(response => {

var data = response.json();

if (data.message) {

// some actions here...

// ...

}

// If 3ds flow

if (data.redirect_url) {

window.location.href = data.redirect_url;

}

});

})

</script>

<INCOUNTRY_EMBEDED_CODE> and <INCOUNTRY_IFRAME_SOURCE> values can be obtained from the InCountry Portal after creating of the Payments service.

When the cardFrom.submit() function is called, the request with payment card data goes through InCountry that redacts this data. Then the request with redacted payment card data comes to your server to the POST /cards endpoint. On your server, the redacted payment card data can be linked to a specific user, etc. The POST /cards method should return a unique entity id in the JSON response in the following way:

{

"x-inc-entity-id": "<generated_entity_id_by_your_app>"

}

Then an entity id and CVV can be passed to the server. In the example above, a request is performed tohttps://your.server.io/buy.

CVV is passed in the plain text form the cardForm function.

cardForm.submit(function(entityId, CVV) {

// ...

});

Client-side validation

The client-side validation is implemented on the basis of the https://github.com/medipass/react-payment-inputs JavaScript library.

This library validates the following:

-

card number:

-

payment card number

-

length of the payment card number

-

-

expiry date:

-

date format

-

validity of the card (non-expired date)

-

-

card’s СVС code:

-

number format

-

code length up to 4 digits

-

Server-side validation

Each payment provider has its own payment data validation. As InCountry Payments only passes requests to the payment provider and in some cases may store, redact, and unredact the payment card data, all backend validation is implemented by the payment provider.

Upon the passed client-side validation, the payment provider’s backend may return a payment data error. By knowing the entity id, InCountry Payments can update the invalid payment card data on the InCountry platform by itself as of the moment of redacting/unredacting data.

Integrating Stripe with Payments

This section provides instructions on how to integrate Payments with Stripe.

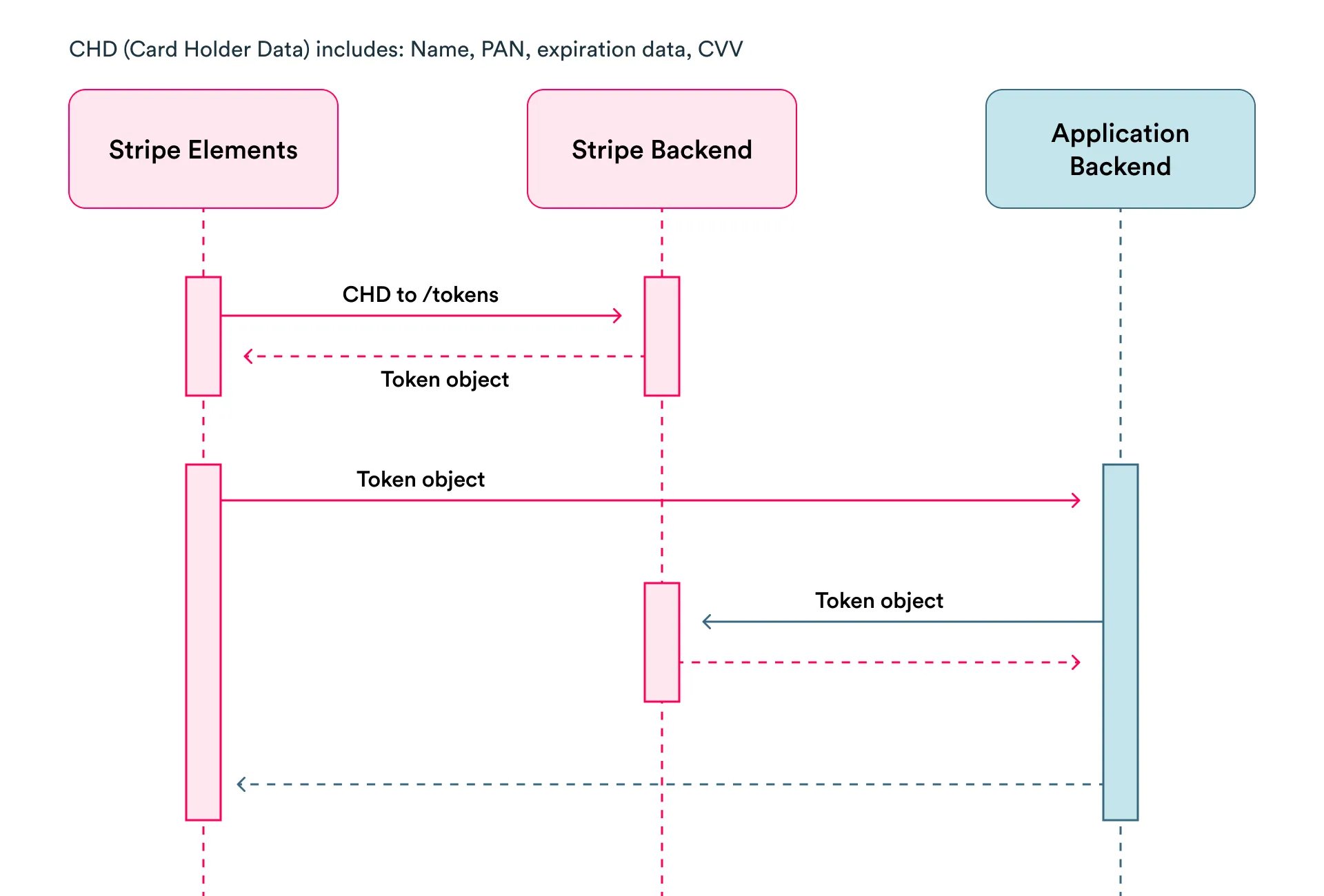

Without InCountry Payments

-

Stripe Elements in your application frontend collect the payment card data.

-

Stripe Elements send the payment card data to the Stripe’s

/tokensendpoint to get the token object that represents a payment card. For the details, please see the create card token article in the Stripe documentation. -

With the token object, the application frontend fetches data from its backend, gets the Stripe credentials, and initiates a payment.

-

Stripe returns the result of the payment transaction.

-

The application backend returns the transaction result to the application frontend.

With InCountry Payments

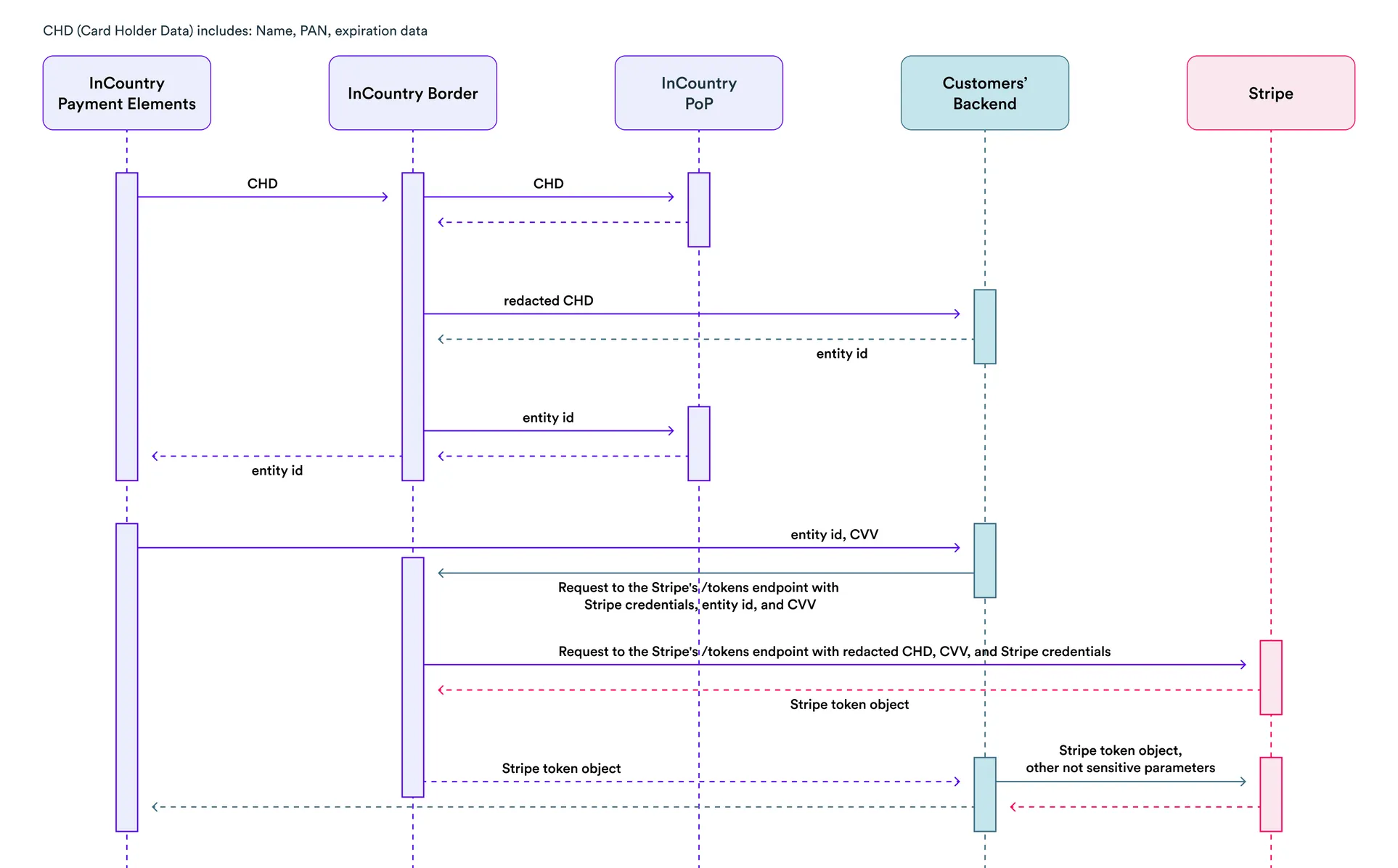

To make a payment transaction in Stripe, you need to create a token object through the Stripe’s /tokens endpoint that represents the payment card data. To create it, you need to pass an entity id to the /tokens endpoint through InCountry Payments that will fill out the request payload with payment card data in the pre-defined format. Then Stripe will create a token and return it back. With that token object, you can charge money from your customers, create recurrent payments, or make direct requests to Stripe.

The following diagram shows the payment flow when using Payments with Stripe:

Example of using Stripe API with InCountry Payments

Below, you can find an example of how to create a token object (with payment card data) for your application backend (the POST /buy endpoint). For example, with Node.js using axios:

const axios = require('axios');

const querystring = require('querystring');

app.post('/buy', async function(req, res) {

const entityId = req.body['x-inc-entity-id']

const cardCvc = req.body.cardCvc

const a = axios.create({

baseURL: `${INCOUNTRY_PAYMENTS_URL}`,

headers: {

'Authorization': `Bearer ${STRIPE_SECRET_KEY}`,

'Content-Type': 'application/x-www-form-urlencoded',

}

});

// Here the request to Stripe will go through InCountry Payments and empty strings will be filled out.

const token = await a.post('tokens', querystring.stringify({

entityId,

'card[number]': '',

'card[exp_month]': '',

'card[exp_year]': '',

'card[cvc]': cardCvc,

}));

// some more actions (charge money from your customer, create recurrent payment, or make direct requests to Stripe)

});

The request to the Stripe’s /tokens endpoint will go through InCountry Payments which will unredact the redacted payment card data and pass it to Stripe for performing a payment transaction.

Moving from One Payment Provider to Another

You may want to add support for another payment provider besides Stripe. InCountry Payments provides provider-agnostic aliases which enable the routing of payment traffic to any number of payment providers you work with. You do not need to secure the sensitive data by yourself.

Data Retention and Deletion

Records with payment card data can be removed on demand and according to our data retention policy (pt. 9.3).

Managing Payments service through Portal

Creating a new Payments service

Payments service operates in the experimental mode with the limited support of payment providers and countries. Help us prioritize our roadmap with payment providers and countries you want to have by dropping an email to us.

You can create one Payments service per each activated country within an environment.

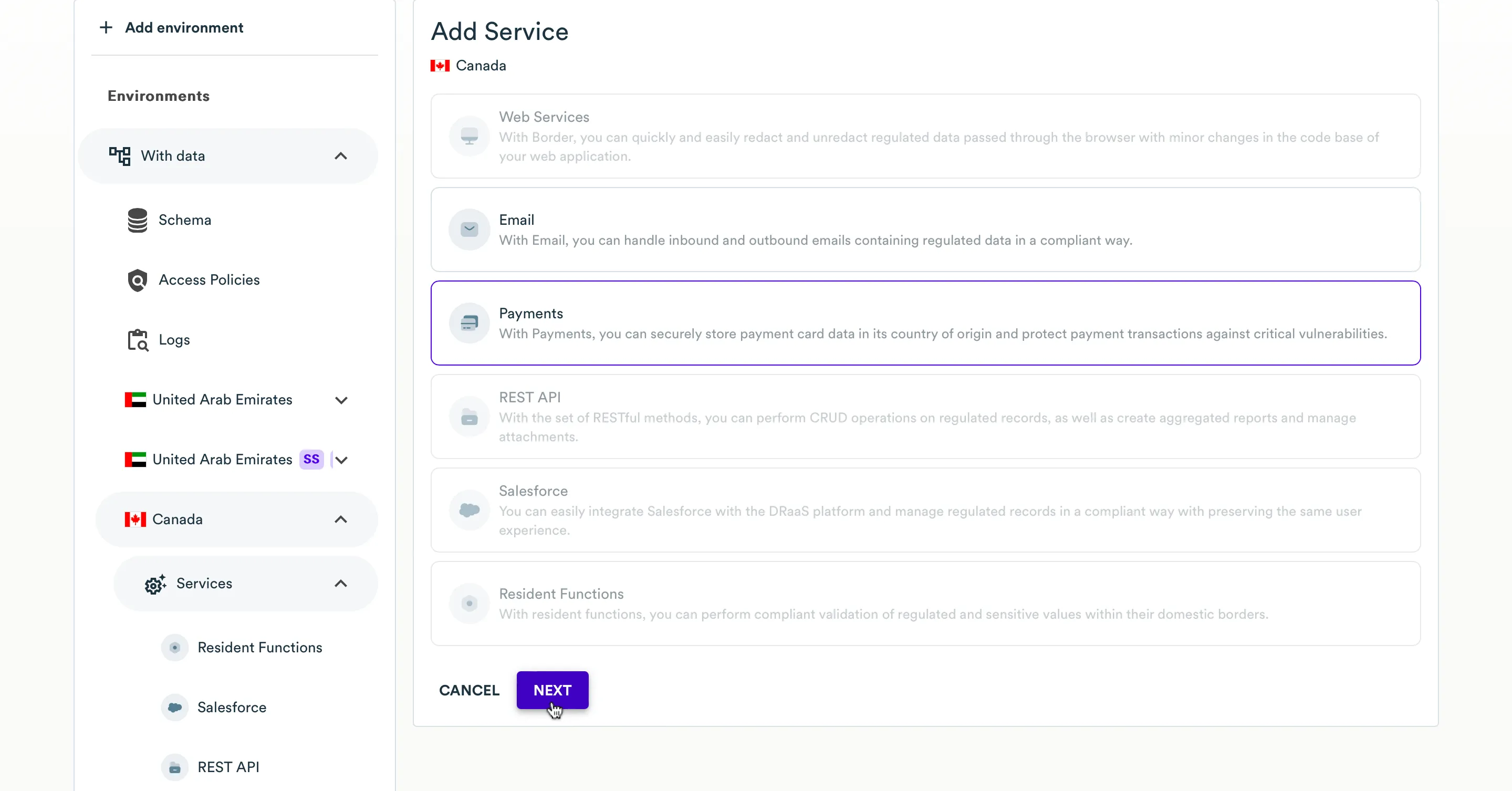

- On the top menu, select Environments.

- On the opened list with environments, select the environment where you want to create the Payments service.

- On the opened list with countries, select the country where you want to create the Payments service.

- On the list of services, click Add service.

- At the Add service step, select Payments.

- Click Next.

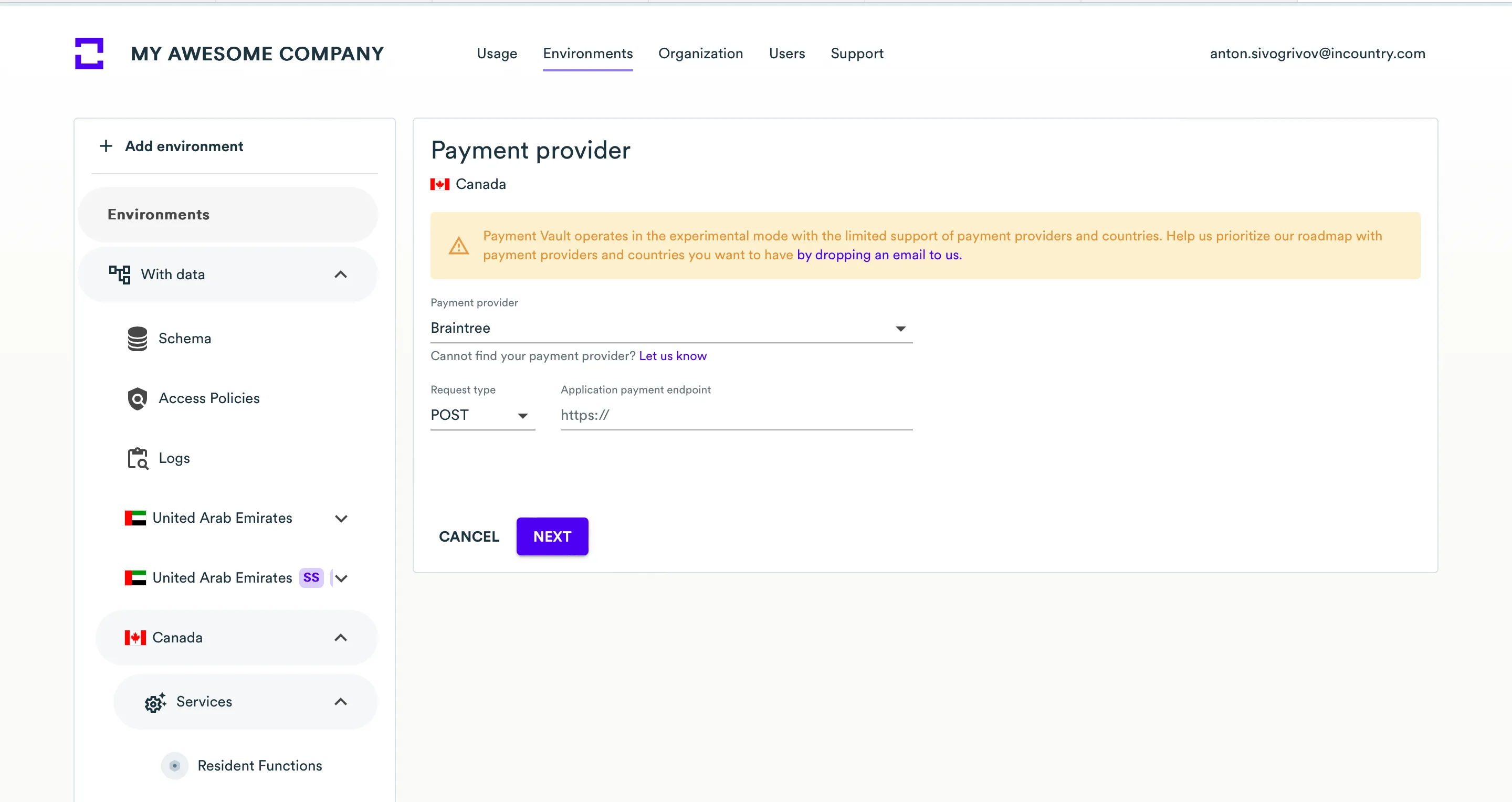

- At the Payment Provider step, define the following parameters:

- Payment Provider – select the payment provider from the list (for example, Stripe or Braintree).

- Request type – leave this parameter as-is, the

POSTrequest type is used by default. - Application payment endpoint – enter the path to the endpoint which payment card data from the payment form is submitted to.

- Click Next.

- At the Review step, review the configuration of a new Payments service.

- Enter the verification code and click Save.

- At the next step, you can see all required parameters to use Payments service and also the code example how to add the payment form (Payment Elements) to your web page that will save payment card data to the InCountry Vault.

- When complete, click Close.

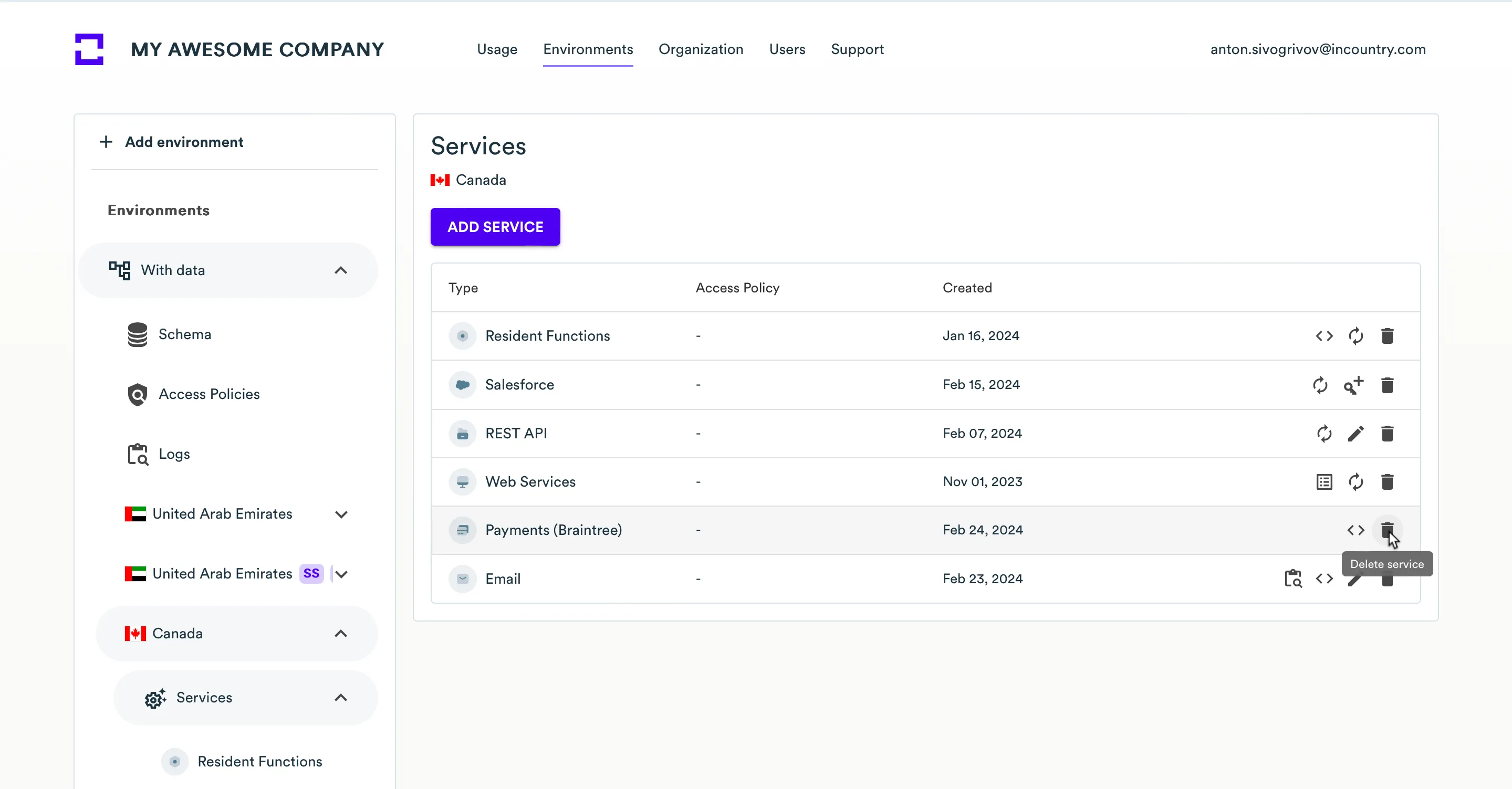

Deleting a Payments service

- On the list of services within an activated country, locate the Payments service you want to delete.

- Click the Delete icon.

- Enter the verification code and click Delete.

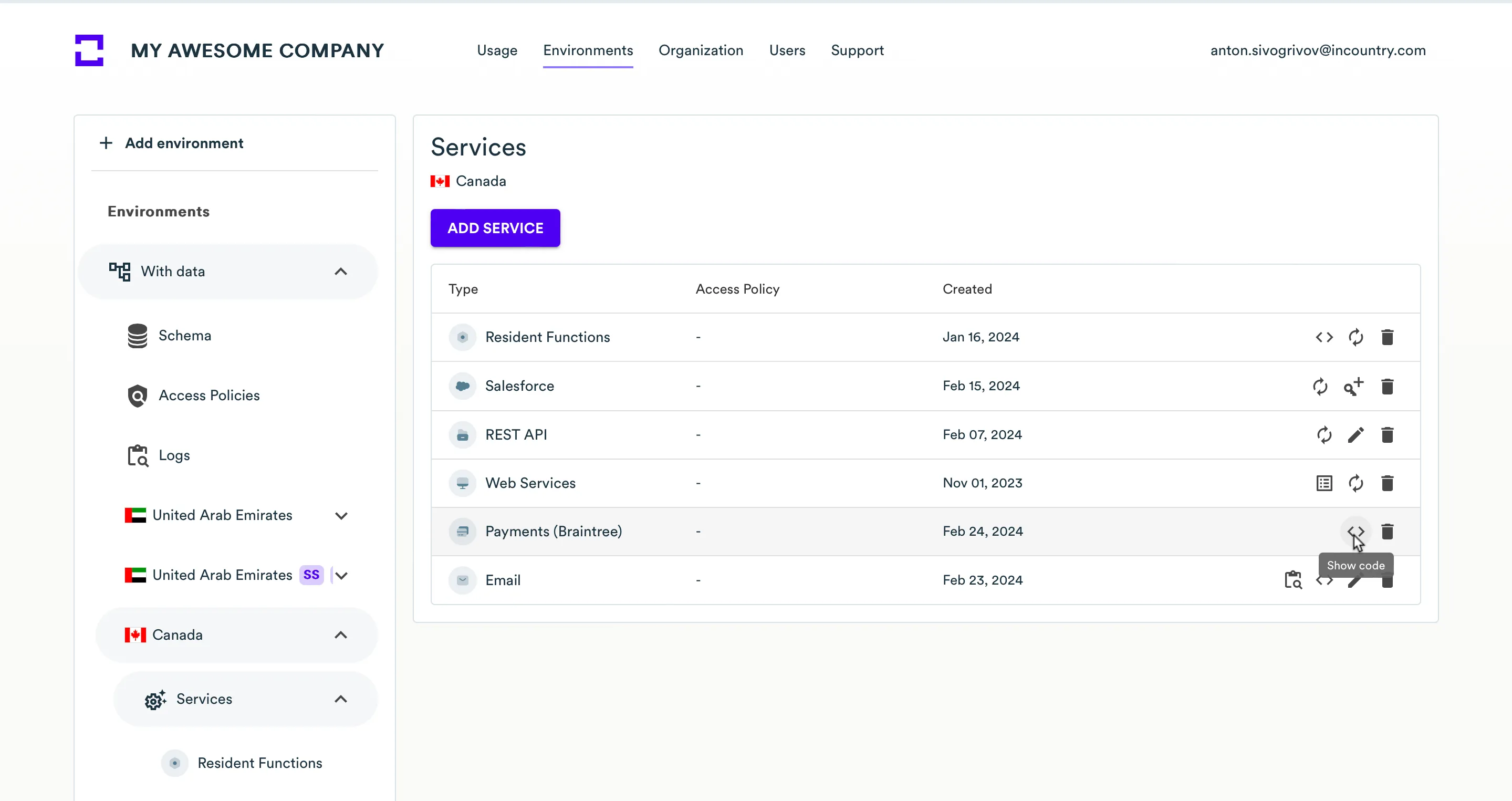

Viewing Payments service details

- On the list with services within an activated country, locate the Payments service you want to see details.

- Click the View icon.

- On the next page, you can see all service details that you need to integrate Payments service.